Whether it’s fuel at the pump, supplies in the field, or inventory in the warehouse, Coast gives you a smarter way to manage every dollar.

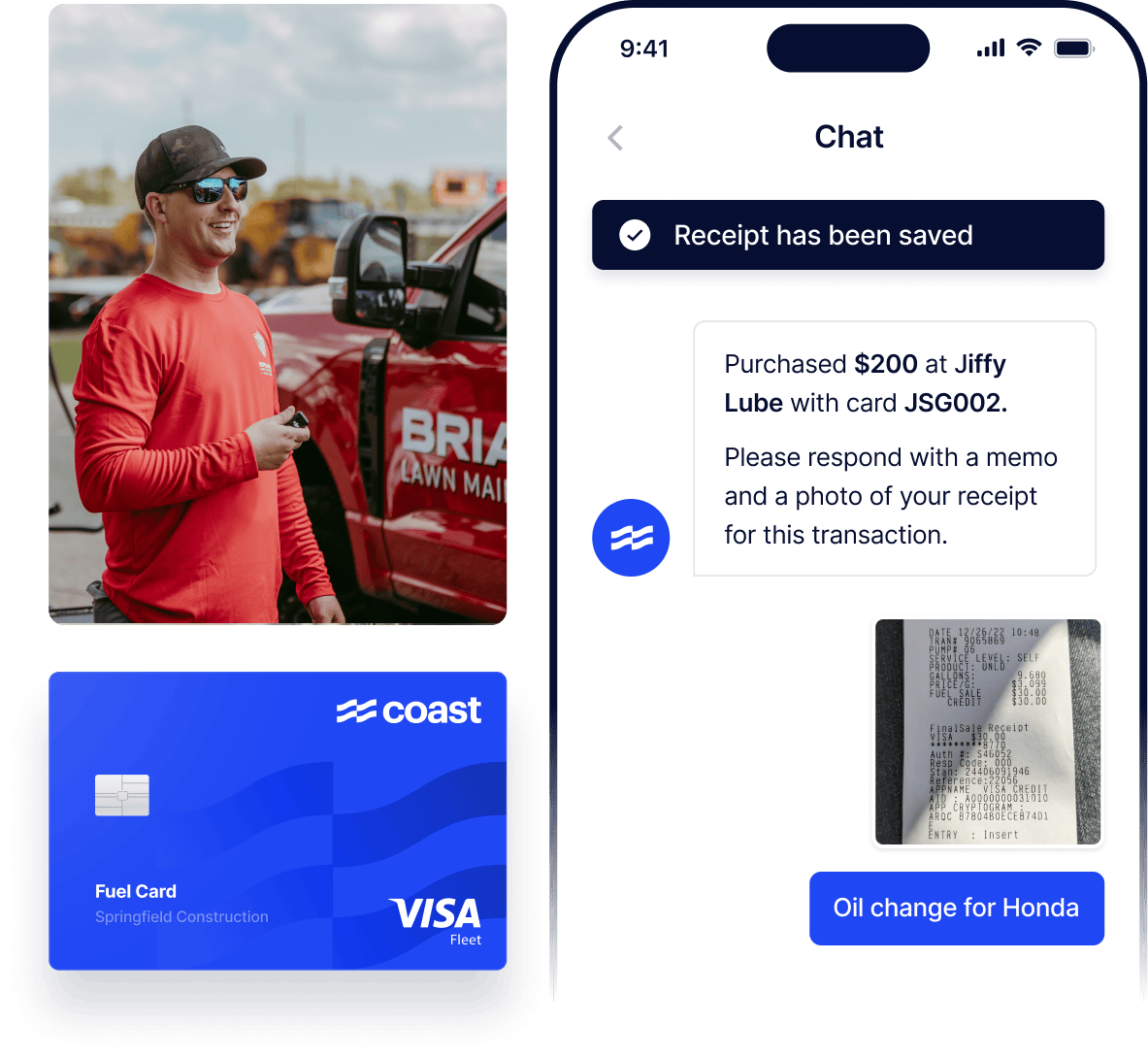

The smartest card for fuel, field, and office expenses

Your fuel card, corporate card, and expense management are now in one place. Businesses with fleets save an average of $30,000¹ a year when they use Coast to control spending and eliminate manual admin processes.

Thousands of businesses trust us

Works for businesses like yours

"We're saving an average of $10,000 a year on our fuel bill and at least 10+ hours of admin time per month. We love how easy and user friendly the system and cards are to use."

Roddy Gato

Support Operations Manager,

Dynaserv Landscaping

Coast connects

to your tools

Connect Coast with the systems you already use to run your business, from telematics to accounting tools. Get real-time insights, stay on top of spending, and uncover new ways to save.

Stop misuse. Prevent overspend.

Protect your business with smarter controls. Set custom rules, block suspicious activity, and get peace of mind with guaranteed protection.

- Set precise rules by driver and vehicle

- Control suspicious transactions based on GPS and fuel tank data

- Get protected with Coast’s $25,000 fuel fraud guarantee²

Choose America's top-rated fuel card

Works where you do. Use your card everywhere Visa is accepted.

Responsive support. Our knowledgeable, 100% US-based team will solve your problem during the call, not after multiple call transfers.

No personal guarantee. Coast doesn’t require a personal guarantee, and won’t affect your personal credit score, either.

Frequently asked questions

Have some questions? We’ve got you covered!

How do I apply for a Coast card?

We offer a fast, simple, online application. In some cases, your application can be approved in minutes. We may need to review more information or documents from you, which may add time to the application process. Once your application is complete, we will get back to you by email within 3 to 5 business days.

We don’t require a personal guarantee, no impact on your personal credit score.

When you apply, we will ask you to provide your personal identifying information as well as basic information about your business, including, any individuals who are beneficial owners of 25% or more of the business and a single individual with significant responsibility to control, manage or direct the business. In some cases, we may ask you to provide additional documentation such as, for example, government-issued identification documents, financial documents such as bank statements or accounting records, or utility bills to verify the information you provide in the application.

How much can I save with Coast?

Our customers save an average of $30,000 per year on fuel and corporate card expenses. Here’s how:

- Rebates add up fast. You get rebates on every gallon on your statement, and up to 9 cents at 30,000 stations nationwide that we partner with.

- Controls stop waste before it happens. Set spending limits, block personal purchases, and prevent fraud with built-in controls that actually work. No more surprise charges or after-the-fact cleanup.

- Smart station selection. Fuel prices can swing 30 cents per gallon between stations in the same area. Coast helps you identify and block expensive stations so your team automatically fuels up at the most cost-effective options.

- Real-time visibility to see where money’s going. Spot issues as they happen, whether it’s a vehicle getting worse mileage or an employee consistently overspending. Coast surfaces these patterns automatically, so you don’t have to dig through reports to find them.

What rebates are available at major gas stations?

You get rebates on every gallon you pump, plus we’ve negotiated extra discounts at 30,000+ stations nationwide. That includes national brands like Exxon, Circle K, and 7-Eleven, as well as regional favorites like Casey’s, RaceTrac, and Maverik. We’re constantly adding new partners, so your options keep growing. Visit the Rewards page to see current rates and partners.

What are Coast’s monthly or annual fees?

We operate on a simple pricing structure. We charge $4 per month per user with one or more complete transactions within the month (active user). This fee gets you access to the entire Coast expense management platform.

If we do not receive the current amount due by your due date, you will be charged the greater of $35 and 2.5% of the amount past due. If any past due amount remains unpaid 31 days after your initial payment due date, an additional $35 or 5% of the full overdue balance will be charged. Returned payments are subject to a flat $35 fee. Coast applies a 2.5% fee to international transactions following conversion into US Dollars.

Visit our pricing page for more details.

Which platforms does Coast integrate with?

Coast integrates with the tools you’re already using, whether it’s telematics, fleet management, field service management, or your accounting systems. We built these integrations to actually save you time and make your financial operations more efficient, not just check a box.

- Telematics that go further. Our integrations with Samsara, Geotab, Verizon Connect, Azuga, and others work both ways. We use GPS data to automatically block transactions when your vehicle isn’t at the pump, flag mismatches between tank capacity and gallons purchased, and pull vehicle info so you’re not entering it twice. It’s fraud protection and accuracy rolled into one.

- Fleet management made simpler. Integrations with Fleetio and WhipAround automatically send fuel and maintenance transactions to your fleet management platform. All your vehicle data is in one place, which means you can actually track your real total cost of ownership, including fuel and maintenance, and without the manual work.

- Effortless accounting. Connect with QuickBooks Online, QuickBooks Desktop, NetSuite, or Sage Intacct to automatically categorize transactions based on your existing fields. Push complete transactions, receipts included, with one click.

- Field service management that ties to jobs. Our BuildOps integration lets your employees assign card expenses to specific jobs as they happen. Get accurate job costs in real time so you can bill correctly and get paid faster.

How is Coast different from other fuel cards?

Most fuel cards were built decades ago and haven’t evolved much since. Coast was built from the ground up for how construction and trades businesses actually operate today.

- Controls that actually prevent fraud. Get rid of PINs that are easy to steal and share. Coast cards are locked by default, and can only be used with a simple yet secure mobile process. Set limits by dollar amount, merchant category, time of day, whatever makes sense for your operation. Block personal purchases with our telematics integrations. And if fuel fraud does slip through? We cover up to $25,000 per year with our fuel fraud guarantee when you use our advanced security features.

- Accurate data you can trust. Other fuel cards rely on whatever the gas station reports, which is often wrong. Coast’s telematics integrations verify every transaction against GPS location and tank capacity, so you know exactly what’s going into which vehicle. No more guessing or manual corrections.

- Integrations that help you make the most of your tools. We connect with the tools you’re already using, such as Samsara, Geotab, QuickBooks, NetSuite, BuildOps, and more. Our integrations work both ways to automate controls, catch discrepancies, and eliminate double entry.

- One card for everything. Use Coast for fuel, vehicle maintenance, job supplies, back-office purchases, whatever your business needs. Our expense management platform is included at no additional cost, so you can easily collect receipts, auto-code transactions, and sync with your accounting system. No more juggling multiple card programs or chasing expense reports.

Can I use Coast for purchases other than fuel?

Yes. We started as a fuel card because we knew we could build something more secure and insightful than what was out there. But we quickly realized fleet-based businesses needed the same level of control for all their expenses, not just fuel.

Use for field and job site expenses. Your drivers and field techs can use Coast for vehicle-related expenses like maintenance and car washes, plus job essentials like supplies, tools, or equipment. You set the rules, block certain categories, limit spending by merchant type, or keep it open if you prefer to give flexibility.

Back-office expenses, covered too. Generate virtual cards instantly for subscriptions, software, and other office purchases. Each card comes with its own controls and reporting, so you always know exactly what’s being spent and where.

What are the benefits of an all-in-one fuel card and corporate card?

Most construction and trades businesses end up juggling a fuel card, one or more corporate cards, and sometimes an expense management tool on top of it all. It works, but managing multiple programs, tracking spending across platforms, and reconciling everything at month-end is a mess.

Coast consolidates it into one program. You get fuel card controls where you need them, spending flexibility where it makes sense, and everything in one place for reporting and reconciliation. No more logging into three different systems or chasing down receipts from multiple cards.

Think of it like this: best-in-class fuel card + corporate card with actual controls + expense management that eliminates expense reports. All for $4 per user per month.